Allowable Expenses Explained

When people just start out in the world of business it’s very likely you’ll hear people talking about phrases such ‘allowable expenses’, ‘tax deductible’, ‘offset against tax’ etc etc. These terms all mean the same thing in regards to the world of tax and business accounting and so I wanted to write up a definitive article as to what ‘allowable expenses’ are, how they work within your tax returns each year and how they can save you money!

What Are Allowable Expenses?

First off let’s talk about what allowable expenses actually are. They are simply expenses which you pay for that are ‘wholly and exclusively’ for the purpose of running your business. So if you need to purchase something that your business couldn’t run without, then this is referred to as an ‘allowable expense’. The reason they are referred to as ‘allowable’ (or ‘tax deductible’ which is technically incorrect but I’ll allow it for the purpose of explaining this!) is because each of these outgoings can be deducted from your business’ overall income. Why? Well it’s the government’s way of helping businesses run and stay in business.

So why is it a good thing to deduct these expenses from your overall income? Because you pay tax on your income! So the less income you’ve made, the less tax you need to pay. It’s as simple as that! So bearing this in mind you need to ensure you know all of the allowable expenses you can claim for in order to help yourself at the end of each year when it comes time to compelte your tax return. How this works in practice is within your tax return you simply write in your total income, write in your total allowable expenses and voila! Your total income is automatically deducted by however much you’ve listed within your allowable expenses.

Now upon first hearing this I know many people get a little crazy and think they can start to claim everything and anything they want to reduce their total income – this is NOT true! The government want to help you run your business, but they’re not stupid. They know if you’re trying to claim something which is blatantly not a business expense and will investigate you and your accounts further if they detect any foul-play. So to be safe here be sure to read my other article all about what you can and cannot claim for as an allowable expense – https://zlogg.co.uk/what-expenses-can-you-claim-for/

How Allowable Expenses Work

Now you know what allowable expenses are, let’s look at how they work! I’ve tried my hardest to simplify this next paragraph however it may sound a little confusing, so if it doesn’t make any sense then be sure to watch the video at the end of the article which has some animated graphics to explain everything better.

The easiest way to explain this is ‘on paper’ is to break it down into 2 stages:

Stage 1: Your Total Income

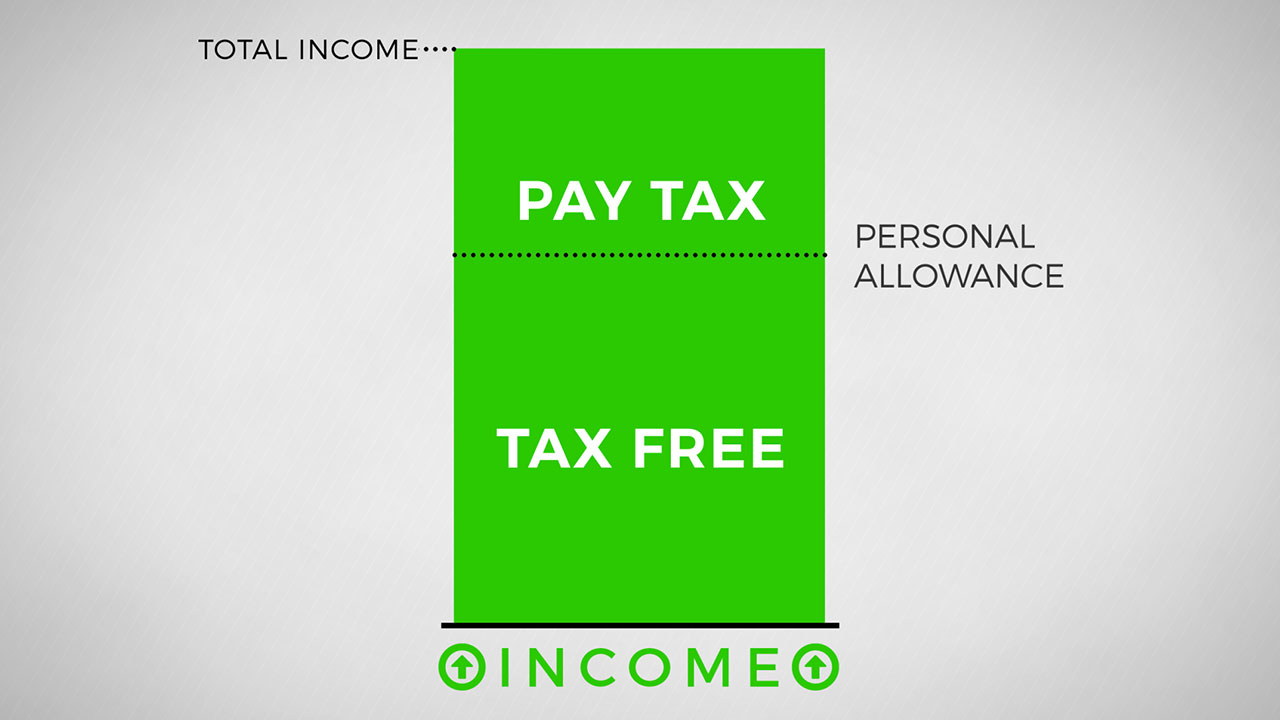

Firstly you simply have the total amount of money which you’ve made this year. We all get a ‘Tax Free Personal Allowance’ (which can change each yearly budget) meaning you don’t have to pay any tax on the total income you earn under this threshold but any amount over this threshold will be subject to tax.

Stage 2: Minus Allowable Expenses

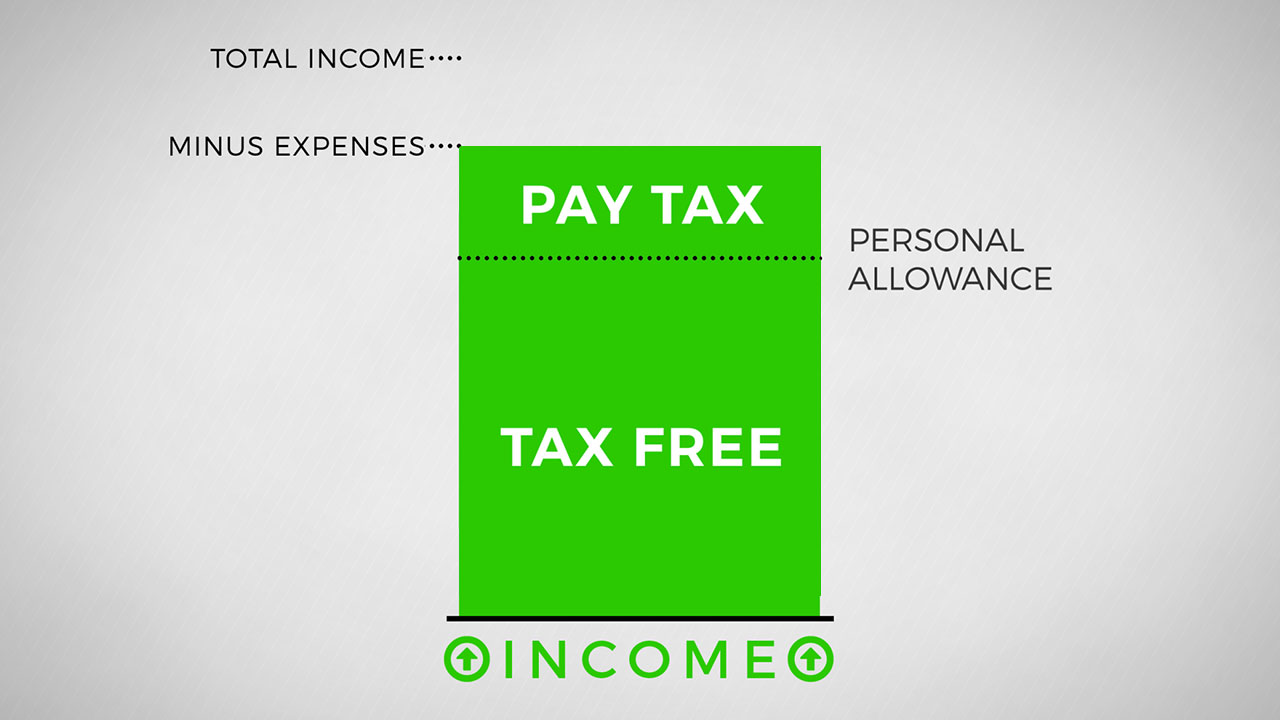

Once your total income is listed, all of your allowable expenses are then deduct from your total income figure – if this amount is still over the personal allowance then you’ll still pay tax but a LOT less than if you hadn’t claimed for any expenses!

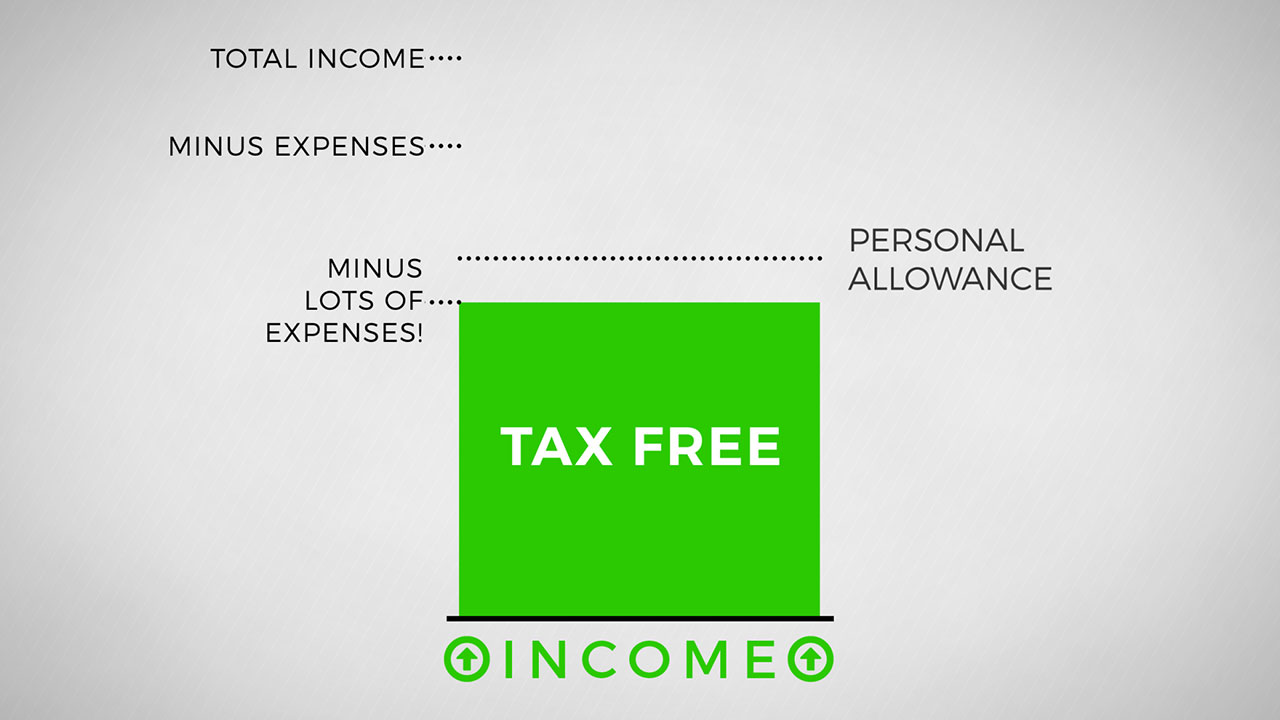

One step further is if you have claimed a LOT of expenses (this generally happens in year one of running a business because you are investing and buying lots of upfront business requirements such as equipment etc) then you may even have enough expenses to deduct a big majority from your total income and get your figure back underneath the personal threshold! If this happens then you of course do not pay ANY tax on that income.

So as you can see it’s imperative to claim ALL of your allowable expenses within your tax return to ensure you are gaining the most out of running your business. Many people get scared of claiming numerous expenses however as long as you can prove each of them are ‘wholly and exclusively’ for the purpose of running your business then you have nothing to worry about and should be claiming them!

As a final note (not to confuse this even more!) going one step further you can even sometimes (especially in year one of setting up a business due to initial investments) claim enough expenses against your overall income that you can take the final amount into a minus number. If this happens then it’s nothing to worry about and is actually a good thing because you can carry this amount over to your next year’s tax return and also offset that minus against your total income as well!

I hope that has helped explain all about allowable expenses, however if you’re still struggling to understand the concept then please feel free to watch this video below or contact me using the contact page and I’ll be glad to help – https://zlogg.co.uk/contact-us/

Share On