How to stop trading as self-employed

So the time may come when you simply want to cease trading as a self-employed person and if that’s the case then it’s very simple to inform the HMRC with 2 simple steps:

Step 1 – Inform HMRC Personally

This isn’t technically a requirement, however I would always recommend informing the HMRC personally that you have ceased trading as a self-employed from whichever date – just so that they can add the information to your account for future reference.

To do this there are two methods:

Online

The quickest and easiest method is to simply visit – https://online.hmrc.gov.uk/shortforms/form/CeaseTrading – fill out and submit the online form which will then tell the HMRC you are no longer self-employed

Telephone

If you’re more of an ‘over the phone’ kind of person then also feel free to call the HMRC directly on 0300 200 3300 and they’ll make a record of the information to your account.

Step 2 – Complete Your Last Tax Return

So even though you may have ceased trading as of today (for example), you’ll still have to complete one last tax return in order to inform the HMRC of all the income you received from the business up until the day you ceased trading.

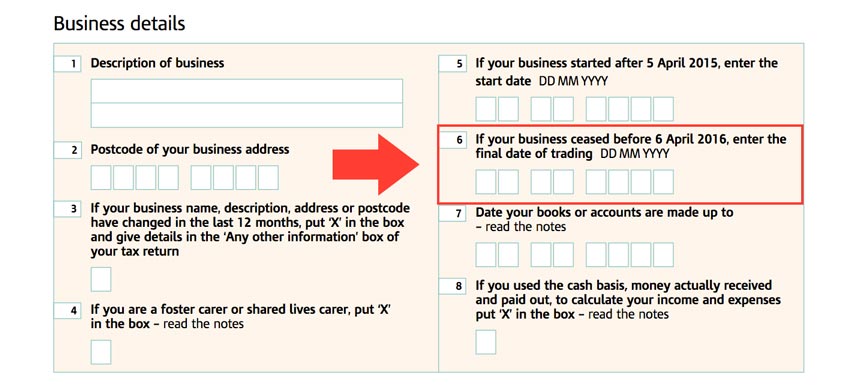

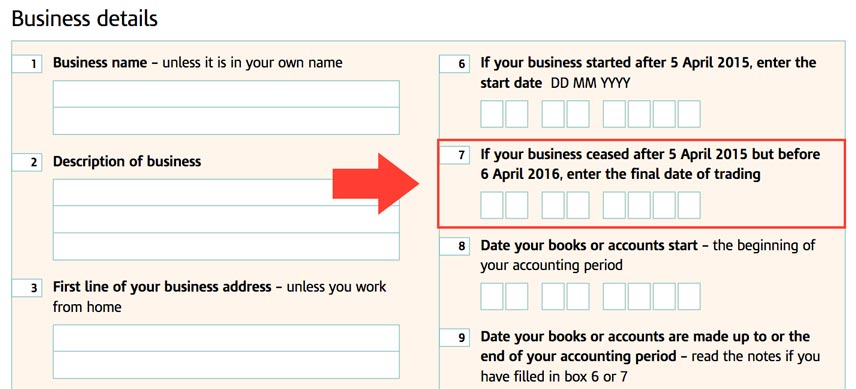

On your tax return you will simply need to add in your ‘final date of trading’ which is a box at the beginning of your Self-Assessment in the ‘Business details’ section. The box is slightly different depending on which tax return form you complete:

Self Employment Form (Short) – SA103S – Box 6

Self Employment Form (Full) – SA103F – Box 7

And that’s it! Once you have followed these two steps and filed your last tax return, you will no longer be self-employed – it’s as simple as that.

Share On